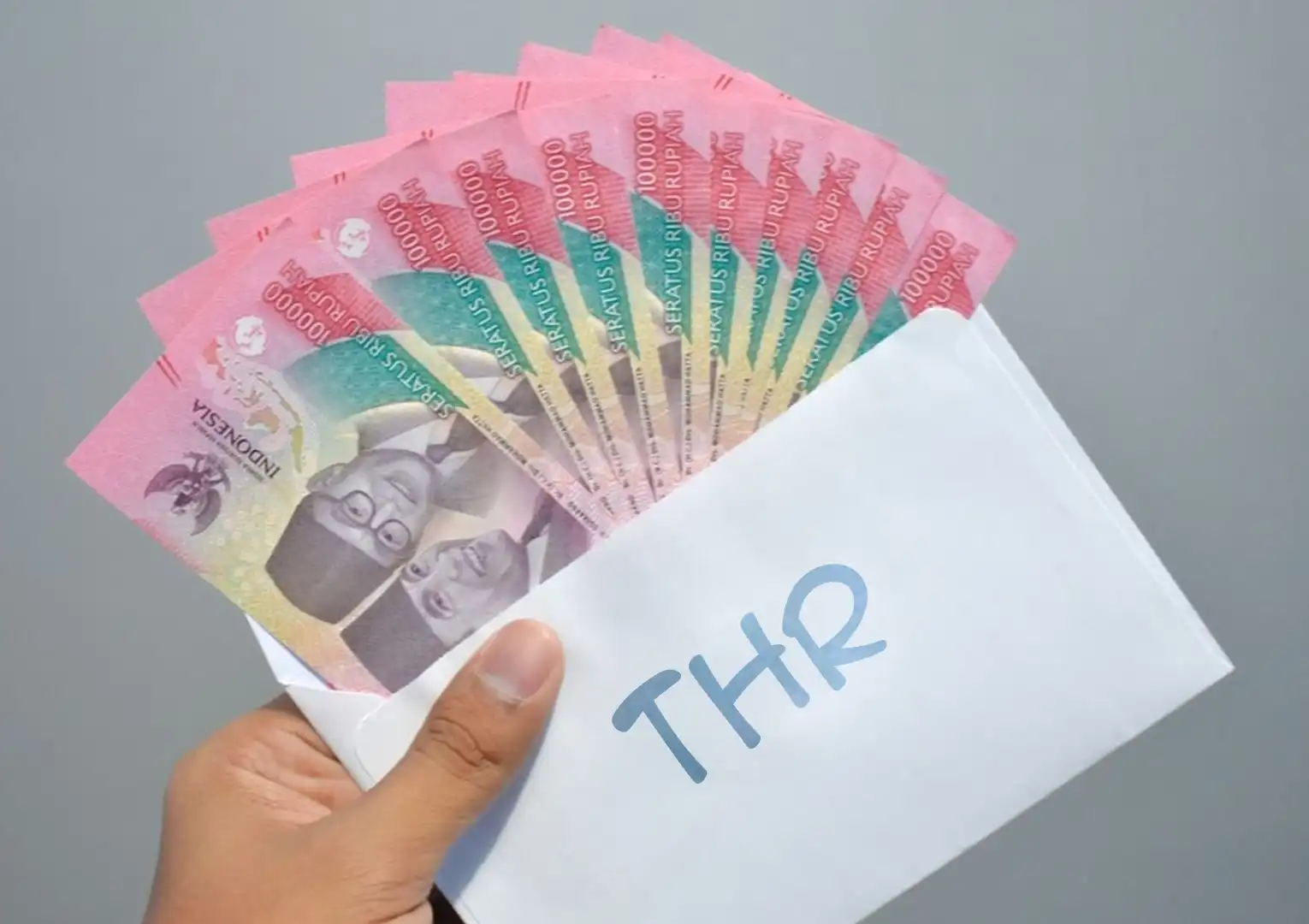

One of the obligations of business owners is to provide holiday allowances (THR) to their employees. The crucial question: When will the 2025 THR be disbursed?

Knowing when employers must pay THR to their employees is crucial to avoiding violating government regulations. You certainly don’t want to face sanctions for being considered absent.

To ensure that you are not late in providing THR to employees, here is complete information regarding when the allowance money should be disbursed and how it is calculated for each employee.

Kapan THR Cair?

The provision of THR in Indonesia is regulated in Article 6 Paragraph (6) of Law Number 13 of 2003 concerning Manpower, which requires employers or companies to fulfill the rights of all their employees by paying THR.

Berdasarkan kebijakan yang sudah berlaku di tahun-tahun sebelumnya, THR untuk karyawan swasta dibayarkan paling lambat tujuh hari sebelum hari raya.

Referring to the Joint Decree (SKB) of the Three Ministers Number 1017 of 2024 and the determination of 1 Ramadan by the Minister of Religion, Eid al-Fitr 1446 Hijriah is estimated to fall on March 31, 2025.

This means that you must pay THR to all employees celebrating Eid al-Fitr no later than March 24, 2025.

Also read: Use Labamu’s Online Store Features to Boost Your Sales During Ramadan!

Employees Entitled to THR and How to Calculate It

The criteria for employees who are entitled to receive THR are those who have worked for at least one month continuously, whether they have the status of an Indefinite Term Employment Agreement (PKWTT), a Fixed Term Employment Agreement (PKWT), or a daily freelance worker.

However, the calculation for employees who have worked for 12 months or more is different from that for employees who have not worked for 12 months. Here are the rules.

1. Employees who have worked for 12 months or more

If you have employees who have worked for 12 consecutive months or more, then they are entitled to receive THR in the amount of one month’s wages.

One month’s wages can consist of several components, such as wages without allowances, net wages, or basic wages with fixed allowances.

2. Employees Who Have Worked for Less than 12 Months

Employees with less than 12 months of service are still entitled to THR, but the calculation is different. The THR received will be calculated proportionally based on their length of service, using the following formula:

(Work Period: 12) x Wage per Month

For example, if an employee is paid Rp. 3,500,000, but has only worked for seven months, then the calculation of the amount of THR received is as follows.

(7 : 12) x IDR 3,500,000 = 0.5833 x IDR 3,500,000 = IDR 2,041,666

So, the THR that must be paid to the employee is IDR 2,041,666.

Sanctions for Failure to Pay THR

If you as an employer do not provide employees with their rights by not paying their THR, then according to Article 79 of Government Regulation (PP) Number 36 of 2021 concerning Wages, you will receive administrative sanctions.

Administrative sanctions that can be given include written warnings, restrictions on business activities, temporary suspension of some or all production equipment, and the most serious is freezing of business activities.

Bagi kamu yang terlambat membayarkan THR juga akan tetap dikenai denda, yaitu sebesar 5% dari total THR yang harus dibayarkan kepada karyawan. Denda akan terhitung sejak batas waktu terakhir kewajiban pembayaran THR, yaitu H-7 hari raya.

THR untuk ASN

For those of you who are currently working as State Civil Apparatus (ASN), you are also entitled to receive THR, like other employees.

However, unlike private sector employees, the THR payment period for civil servants (ASN) is slightly earlier, approximately 10 days before the holiday. So, if the government determines Eid al-Fitr falls on March 31, 2025, you can receive your THR on March 21, 2025.

ASN and non-ASN groups entitled to THR

The following are ASN groups who are entitled to receive THR.

- State apparatus, consisting of ASN, Prospective Civil Servants (CASN), Government Employees with Work Agreements (PPPK), TNI, Polri, and state officials.

- Retirees and benefit recipients, such as retirees, pension recipients, and civil servant benefit recipients.

Then, the non-ASN groups who are also entitled to receive THR are as follows.

- Signing an employment agreement with an authorized official, in accordance with the provisions of laws and regulations.

- Have a letter of appointment in accordance with the provisions of laws and regulations, which have stipulated that the recipient is entitled to receive holiday allowances and/or 13th salary by the personnel development officer.

ASN Groups Not Entitled to THR

Based on Article 5 of PP Number 14 of 2025, there are groups of ASN who are not entitled to receive THR, namely below.

ASN who are on leave without state responsibility

ASN who are assigned outside government agencies and are paid directly by the agency where they are assigned, either domestically or abroad.

That explains when THR is due and the regulations set by the government. So, don’t be late or miss out on paying THR to employees. Also, make sure you receive the THR you’re entitled to.

If you need help managing your business during the holiday season, Labamu is a great option. This app has an Employee feature that can help you ensure your store continues to operate safely and avoid fraud, even while you’re on holiday with your family to celebrate Eid.

Besides the smartphone app, Labamu can also be accessed on your laptop or PC using the Labamu Desktop feature. Enjoy easy access anytime, simply by opening it from a browser and logging in with your email.

Additionally, Labamu has many other useful features that can help your business grow, such as Reports, Invoices, and even a Payables Book. So, what are you waiting for? Download Labamu now on Google Play or the App Store!